Bitcoin has been the leader of the cryptocurrency market since its inception in 2008. It holds the biggest market share, it’s the most stable cryptocurrency, and it’s the inspiration behind an ever-growing list of followers and spinoffs. It therefore makes sense why most people joining the crypto space only focus on the cryptocurrency.

However, the crypto world is full of creativity, and this has given rise to many different cryptocurrencies that have propelled the space to even greater heights. These alternative assets, or altcoins, offer unique features and investment opportunities that you can take advantage of as an investor and grow your portfolio. Today, we’ll look at some of the best, excluding stablecoins.

A crypto expert notes that, “The recent decline in #Bitcoin price from $70,000 to approximately $66,000 marks a decrease of over 5%. This correction is seen as a necessary step in preparing for further bullish momentum. As I previously mentioned, as long as the price remains within the range of $60,000 to $70,000, the overall outlook remains positive.”

- Ethereum (ETH)

Ethereum holds the second largest share of the cryptocurrency market after Bitcoin. The blockchain technology was developed in 2015 by Vitalik Buterin, and it brought a unique aspect that makes it very popular to this day – smart contracts.

The technology makes it possible for developers to create decentralized applications (dApps) that can carry out complex transactions without the interference of a third party.

Once the smart contract is created, two parties can transact in a secure and transparent manner using the blockchain’s cryptocurrency, Ether (ETH).

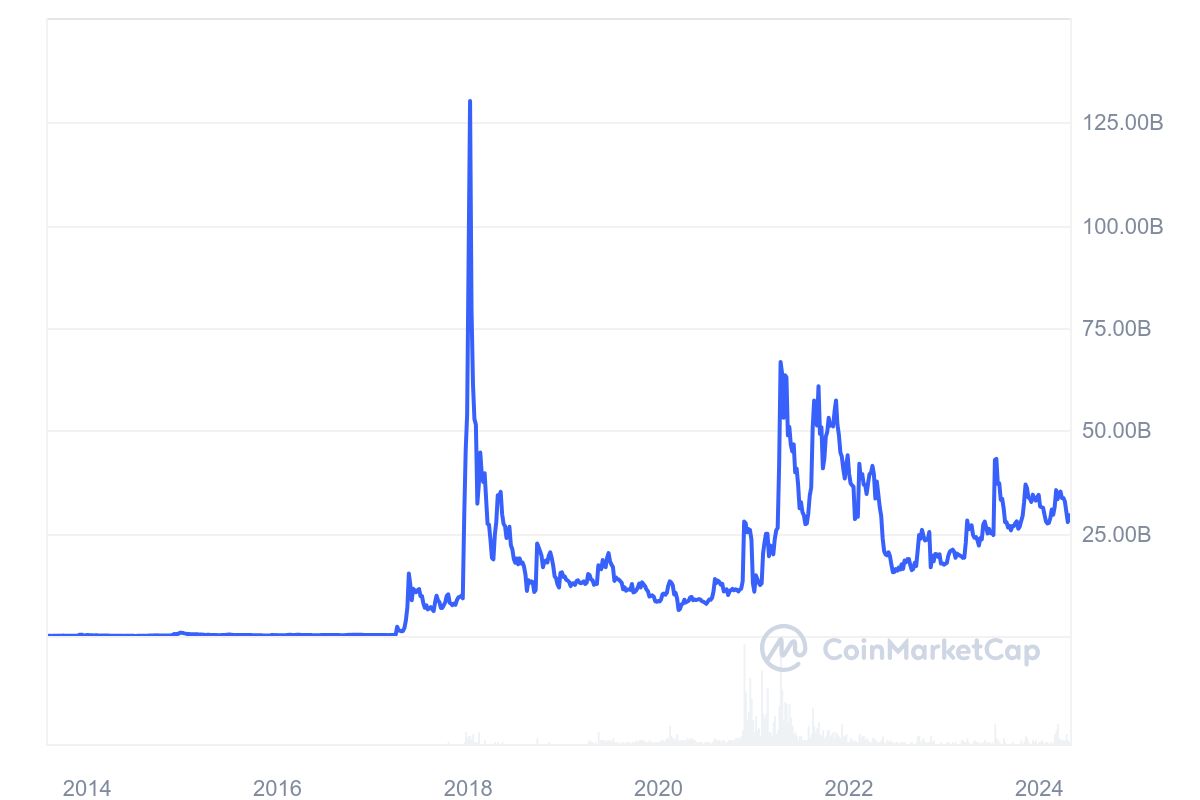

The graph above show the price of Ethereum for a period of one years as at 24th April 2024.

Ethereum Market Cap, 24 th April 2024

This capability of self-execution (and trust) is also what has brought the rapidly growing areas of decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized exchanges (DEXs), and more.

Besides its utility, Ethereum is known for its strong community of developers and enthusiasts who back innovative technology. These have been responsible for several upgrades that continue to make the network and crypto even better, and it’s only expected to grow further.

Ethereum Unique Value Proposition

Ethereum is unique since it pioneered smart contracts, that enables developers to build decentralized applications (DApps) as well as execute programmable agreements without intermediaries.

Its vast ecosystem of tokens, DeFi protocols, and NFT marketplaces highlights its versatility.

Ethereum powers a wide range of applications, including decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized exchanges (DEXs), gaming, and more. It is one of the Bitcoin alternatives that has a high potential compared to other altcoins.

Recent Developments of Ethereum as April, 2024

Ethereum’s transition to Ethereum 2.0 aims to address scalability issues through the implementation of proof-of-stake (PoS) consensus mechanism . The recent London hard fork introduced the EIP-1559 upgrade, which aims to improve transaction fees and create a deflationary mechanism.

Potential Future Outlook: Ethereum’s future outlook is promising, especially with the continued development of Ethereum 2.0. As scalability improves and gas fees become more predictable, Ethereum is likely to maintain its position as a leading platform for decentralized applications. For more on Ethereum you can read Ethereum white paper here.

Pros

- Innovative technology with smart contracts, enabling dApps various DeFi solutions.

- Has a strong community of developers behind it. They constantly improve the platform.

- Second largest cryptocurrency by market cap. Offers liquidity and stability.

Cons

- Gas fees can be high when the network is congested.

- Facing tough competition from newer platforms offering similar functionalities.

- Binance Coin (BNB)

Binance is the largest crypto exchange platform in the world by trading volume, and it also has its own cryptocurrency – Binance Coin (now just BNB). Due to the position of Binance in the crypto space, this crypto has greatly expanded to become the third largest in the market. As of April 2024, it has a market of around $83 billion.

The cryptocurrency was started in 2017 as an ERC-20 token operating on the Ethereum network. However, it quickly grew and moved to its own blockchain, BNB Smart Chain, an Ethereum-compatible smart contract platform. In 2023, this blockchain merged with Binance Chain, which was mostly used for staking and governance. This gave birth to the BNB Chain, which is a high-performance blockchain that uses Ethereum’s proof-of-stake system to validate transactions.

Today, BNB operates as the main method of paying transaction fees on Binance, and it’s also a popular asset for token sales and initial coin offerings (ICOs) conducted on the Binance Launchpad platform. The cryptocurrency is fast yet very affordable for making transactions.

The graph above shows the price of BNB for one year as of 24th April 2024.

The graph above shows the market cap of BNB for one year as of 24th April 2024.

Due to its Ethereum basis, BNB also plays a very important role in the DeFi space. It is quite popular in the creation of dApps as it has a huge community behind it.

Unique Value Proposition of BNB

Binance Coin serves as the native utility token for Binance ecosystem which is one of the largest cryptocurrency exchanges globally. It offers various utilities within the Binance platform. It includes fee discounts on trading, participation in token sales on Binance Launchpad, payment for goods and services, and staking rewards.

Applications of BNB

BNB’s applications extend beyond the Binance exchange to decentralized finance (DeFi), gaming, non-fungible tokens (NFTs), and more. Its integration with Binance Smart Chain (BSC) has enabled the development of numerous decentralized applications (DApps) and platforms.

Recent Developments of BNB as at April, 2024

Binance Coin has seen significant growth in DeFi activity, with projects like PancakeSwap, Venus, and BakerySwap gaining traction on the Binance Smart Chain. Binance continues to expand its ecosystem through strategic acquisitions, partnerships, and initiatives, such as the Binance NFT marketplace.

Potential Future Outlook of BNB in 2024

Binance Coin’s future outlook is closely tied to the success and growth of the Binance ecosystem. As Binance continues to innovate and expand its offerings, BNB’s utility and value are likely to increase. The integration of BNB into various applications and services, along with its strong community support, could drive its adoption and usage across different sectors of the cryptocurrency industry.

Pros

- It’s backed by the largest crypto change, so it has high utility.

- Offers affordable transaction fees and fast processing times.

- Supports smart contracts and staking.

Cons

- Value is depended on the reputation of Binance.

- Limited utility outside the Binance ecosystem may hinder long-term growth prospects.

- Solana (SOL)

Solana was created in 2017 as an improved version and direct competitor of Ethereum, earning the moniker ‘Ethereum killer.’ This is because its platform is designed to support decentralized applications (dApps) like Ethereum, but it does many more transactions per second than Ethereum and charges far less.

The graph above shows Solana’s price for one year as of 24th April 2024.

To make this possible, the Solana Blockchain combines two consensus mechanisms – Ethereum’s Proof of Stake (Pos) and a unique Proof of History (PoH) mechanism. PoH timestamps transactions, which are then written on the underlying PoS mechanism. This helps make it possible for the blockchain to process thousands of transactions per second.

The provision of a faster and cheaper platform for smart contracts and dApps has made Solana a big player in the crypto space, and it has a market cap of over $64 billion as of April 2024.

Unique Value Proposition

Solana offers high throughput and low latency, making it suitable for decentralized applications requiring fast transaction speeds and high scalability. Its architecture is designed to support complex DeFi protocols and real-time gaming applications.

Solana’s applications include decentralized finance, decentralized exchanges, gaming, non-fungible tokens, and more.

The recent developments is its increased and developer activity, with projects like Serum DEX and Mango Markets gaining traction. Partnerships with major DeFi projects and integration with popular wallets and exchanges have further accelarated Solana’s ecosystem.

Potential Future Outlook for Solana is its performance and growing ecosystem position it as a strong competitor in the blockchain space. Continued adoption by developers and users, along with further protocol upgrades, could propel Solana to greater heights.

Pros

- Positioned as the biggest competitor to Ethereum, offering scalability and speed advantages.

- Unique consensus mechanism combining PoS and PoH

- Has a rapidly growing ecosystem, with a vibrant and dynamic community behind it.

Cons

- Relatively newer platform

- Vulnerable to technical issues or vulnerabilities (such as fake tokens) as it continues to scale.

- Ripple (XRP)

XRP is another significant player in the crypto market, and it has a market cap of about $27 billion. The digital asset is the cryptocurrency of the Ripple protocol, and it was developed by Ripple Labs in 2014. However, unlike crypto like Bitcoin and Ethereum, XRP is not decentralized. The crypto operates on a centralized financial payment network as it has a different goal than most major cryptocurrencies – facilitate real-time cross-border payments.

In other words, XRP is more like a blockchain version of a system like SWIFT. However, the fact that it’s based on blockchains means that it’s faster and much cheaper than traditional payment methods. To make transactions possible, XRP doesn’t rely on mining like Bitcoin but rather a network of servers operated by Ripple Labs. It’s supply is therefore determined by Ripple Labs, but it is capped at 100 billion tokens.

Due to its instant and cost-effective cross-border transfers, XRP has been embraced by various financial institutions, and it continues to collaborate with regulators and financial institutions to drive adoption.

Unique Value Proposition of XRP

Ripple sets itself apart with its focus on facilitating fast, low-cost cross-border payments and settlements. Its network, RippleNet, offers financial institutions and payment providers a platform for secure and efficient global transactions using XRP as a bridge currency.

Applications of XRP

XRP’s can be applied when doing cross-border remittances and payments. It enables instant and cost-effective transactions between parties globally. Ripple’s solutions also extend to liquidity management, real-time gross settlement systems, and digital asset exchange.

Recent Developments in XRP 2024

Ripple(XRP) has continued to expand its partnerships with financial institutions and payment providers globally. Its aim is to increase the adoption of RippleNet and XRP for cross-border payments.

Potential Future Outlook for XRP

Despite facing regulatory challenges, Ripple’s technology and partnerships position it as a significant player in the global payments industry.

As cross-border payments become increasingly digitized and streamlined, XRP’s utility as a bridge currency could drive its adoption and value.

Continued expansion of Ripple’s network and regulatory clarity could contribute to its long-term success.

Pros

- It’s real-time cross-border payments are continuing to attract partnerships with financial institutions.

- Faster and cheaper transactions compared to traditional payment methods like SWIFT.

- Controlled supply and centralized network provide stability and predictability.

Cons

- Centralized nature works against the decentralization ideology of cryptocurrencies.

- Often faces legal battles and regulatory scrutiny as it steps on traditional finance.

Bitcoin Alternatives – Frequently Asked Questions

What is Bitcoin’s biggest competitor?

The biggest Bitcoin competitor is Ethereum. The platform is mainly used as a platform for smart contracts and decentralized apps.

Should I buy Bitcoin or altcoin?

Bitcoin is considered a “blue chip” crypto as it’s time-proven and has a large market value and liquidity. However, altcoins are also a good investment avenue if you want to risk more for the possibility of higher returns.

Is Bitcoin a better store of value than altcoins?

Yes. If you are looking to hold your crypto over the long term, Bitcoin is less risky than altcoins.

Where can I buy cryptocurrency?

You can purchase cryptocurrency at a crypto exchange platform such as Binance or Coinbase.

Can any other cryptocurrency beat Bitcoin?

While altcoins offer unique features and functionalities, Bitcoin’s dominance in market share, brand recognition, and security make it hard to beat as the leading store of value in the cryptocurrency space. However, advancements in technology could potentially lead to an altcoin emerging as a more suitable choice for everyday transactions.

Why does Ethereum want to change from proof of work to proof-of-stake validation mechanism?

Ethereum switched to Proof-of-Stake (PoS) to be more efficient and sustainable. PoS uses less energy than Proof-of-Work (PoW) and allows for faster transaction processing.

References

https://cryptoticker.io/en/solana-latest-update

https://cryptoticker.io/en/top-5-solana-blockchain-alternatives

https://coinmarketcap.com/community/post/335937688

https://coinmarketcap.com/community/articles/66296716d8ba79594681d69c

https://coinmarketcap.com/community/articles/662964bdd8ba79594681d696

https://www.coindesk.com/learn/what-is-the-merge-and-why-has-it-taken-so-long