Which crypto are stablecoins?

Cryptocurrencies have become quite popular as they allow users to make transactions without relying on centralized institutions such as banks. However, while crypto has been widely embraced, the aspect of high volatility always makes most users apprehensive and can also lead to huge losses.

Thankfully, stablecoins have come up as an avenue for stabilizing crypto holdings. They have even enticed major financial players such as PayPal, who have created their own stablecoin – PayPal USD (PYPUSD). So, what exactly are stablecoins, and which are the most popular?

Stablecoins Explained

Stablecoins are cryptocurrencies that have their value pegged on real-life assets.

These can be a currency such as the US Dollar, a commodity such as physical gold, or a financial instrument such as bonds.

The goal of these cryptocurrencies is to offer a stable value in the crypto market. For example, if a crypto is pegged on the US Dollar, it will always maintain the value of the USD.

Due to this, stablecoins are mostly used as a medium of exchange. For example, if you wanted to buy Bitcoin using your local currency, you would first need to buy a stablecoin such as Tether USD (USDT) from a crypto exchange’s P2P marketplace. You can then convert your USDT to Bitcoin when the asset reaches a desired price.

Due to their utility, stablecoins enjoy the highest trading volume in the crypto space. According to CoinMarketCap, USDT almost doubles the trading volume of Bitcoin in a 24-hour space.

What are the Most Popular Stablecoins?

Below are the most popular stablecoins based on market cap. The figures were sourced from CoinMarketCap on 26th April 2024.

- USDT (USDT)

- Market Cap: $110 B

- Daily Trading Volume: $51 B

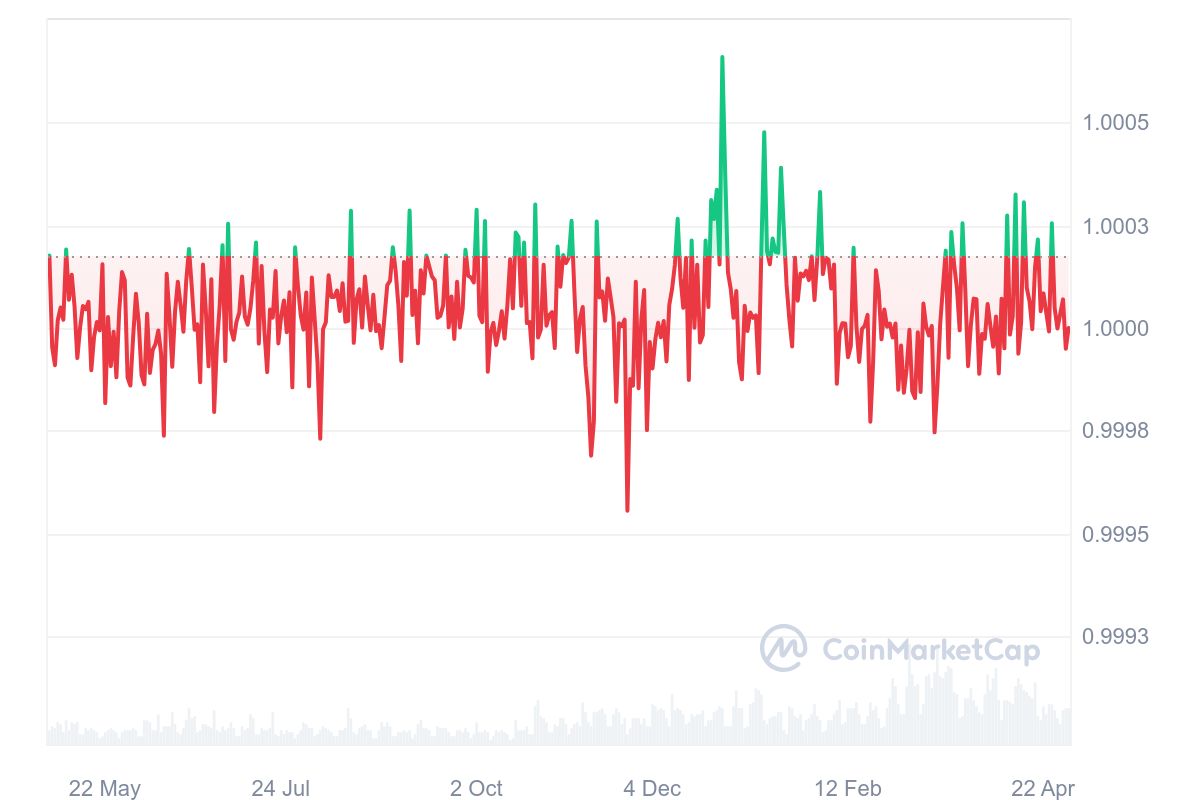

Tether USDT price graph for the past 1 year as of April 2024.

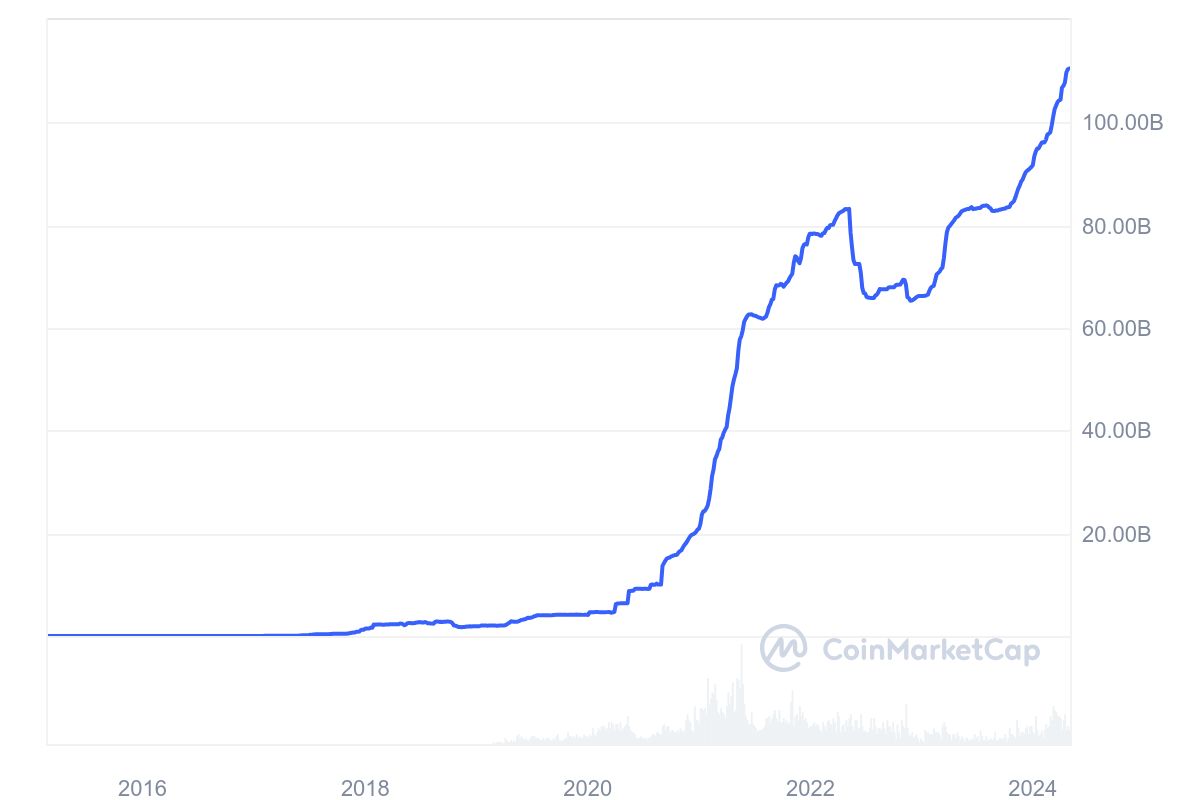

Tether USDT market cap graph for the past 8 years as of April 2024.

Tether USD (USDT) is one of the original stablecoins, having started in 2014. It is operated by a company known as Tether Limited, which also has several stablecoins pegged on different assets such as gold.

As for USDT, the cryptocurrency is pegged to the price of the US Dollar.

According to Tether Limited, the company holds 1 actual US dollar in reserves for every USDT token in circulation. However, there have been controversies about transparency, although they haven’t affected the cryptocurrency.

USDT has become the most popular trading pair for most cryptocurrencies, including Bitcoin. It is usually used as a store of value, allowing traders to convert their cryptocurrencies and avoid volatility.

USDT boasts the largest daily trading volume of all cryptocurrencies.

- USD Coin (USDC)

- Market Cap: $33 B

- Daily Trading Volume: $7 B

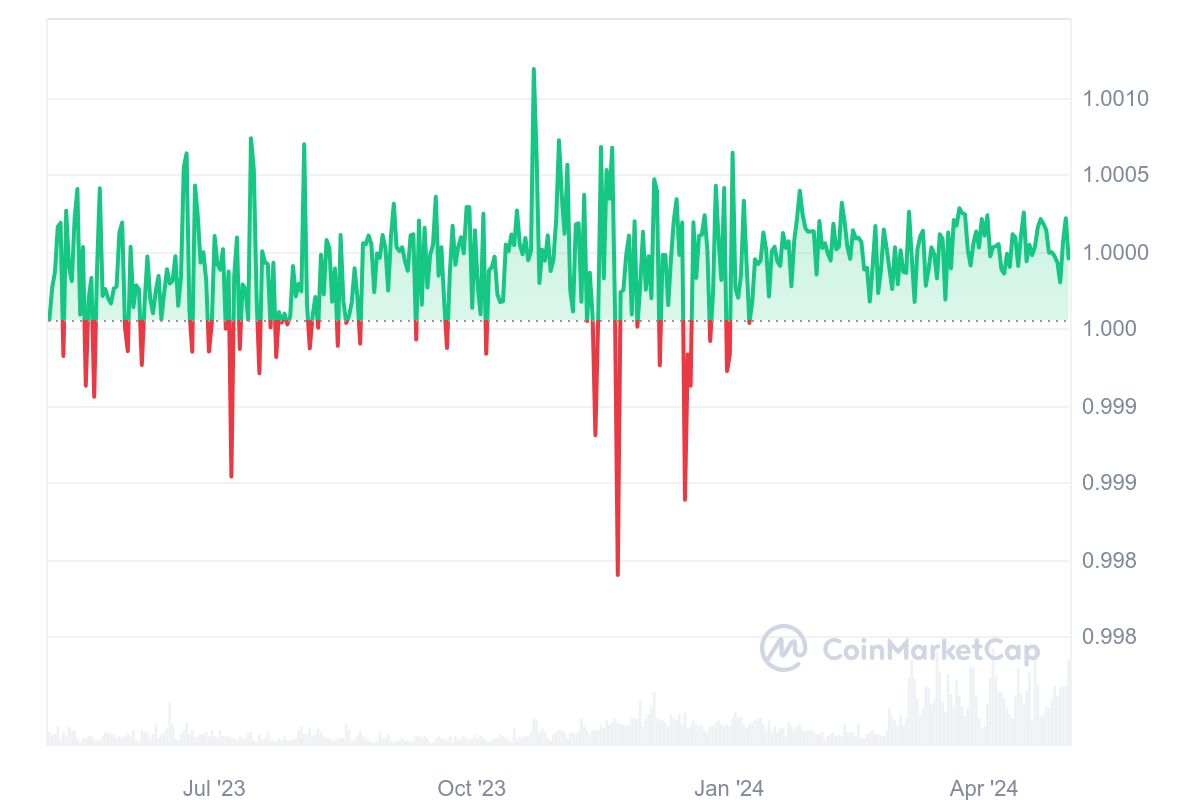

USDC price graph for the past 1 year as of April 2024.

USDC market cap graph for the past 8 years as of April 2024.

USD Coin (USDC) was launched in 2018 as a collaboration between crypto firm Circle and crypto exchange firm Coinbase through the Centre Consortium.

The involvement of Coinbase gave it much fanfare and sped up its market penetration.

USDC is pegged to the US dollar using actual reserves, although it has diversified to other assets, just like USDT. A unique aspect of the coin is that it is based on an open-source protocol, which means any person or company can use it to develop their own products.

In itself, it’s an ERC-20 token, so it operates on the Ethereum Blockchain. This has helped the cryptocurrency gain significant adoption in the DeFi (Decentralized Finance) space. Holders can use it as collateral for loans, as a liquidity pool asset, and for yield farming.

However, USDC openly has a backdoor that has previously been used to freeze $100,000 of the stablecoin at the behest of law enforcement.

- Dai(DAI)

- Market Cap: $5 B

- Daily Trading Volume: $685 M

Dai market cap graph for the past 4 years as of April 2024.

Dai price graph for the past 1 year as of April 2024.

Dai was created in 2017 by MakerDAO, a decentralized autonomous organization (DAO) that started in 2014. The aim of the stablecoin was to take control of stablecoins away from central institutions.

As such, Dai is based on blockchain, specifically Ethereum. The stablecoin mimics the value of the US dollar, but its collateral is Ether (ETH) and other authorized cryptocurrencies.

Since there’s no central authority, the price of DAI is controlled by smart contracts, which are inherent to the Ethereum network. To create Dai tokens, a user needs to provide their cryptocurrency as collateral.

They’ll then get tokens they can use to purchase goods and services or trade on cryptocurrency exchanges.

But while DAI is mostly backed by Ethereum, this doesn’t mean that it’s price drops with the crypto. The smart contract has algorithms it can use to balance this out.

That said, it’s still vulnerable to unknown smart contract weaknesses that may show up. A particular manipulation led to a loss of $8 million in 2020.

- First Digital USD (FDUSD)

- Market Cap: $4 B

- Daily Trading Volume: $8 B

First Digital USD FDUSD price graph for the past 1 year as of April 2024.

First Digital USD FDUSD market cap graph for the past 2 years as of April 2024.

First Digital USD (FSDUSD) is one of the newest stablecoins, having only launched in June 2023.

The coin is issued by a subsidiary of Hong Kong-headquartered financial firm First Digital Limited, and it currently operates on two blockchains – Ethereum and BNB Chain. This means that the coin can be used in DeFi applications to do yield farming, lending, borrowing, and staking.

FDUSD is pegged on the US dollar, but its reserves are more diversified than those of other stablecoins. Besides actual dollars, the cryptocurrency relies heavily on short-term US Treasury Bills.

The stablecoin has quickly grown in popularity, and today, it boasts the second-highest daily trading volume, only behind USDT.

Comparison of the above Stablecoins by Market Capitalisation as of April 2024

| Stablecoins | Market Capitalisation |

| Tether (USDT) | $110,258,908,025 |

| USDC | $33,408,502,458 |

| Dai | $5,204,347,158 |

| First Digital USD | $4,392,001,613 |

Comparison of the above Stablecoins by Market Dominance and Trading Volume as of April 2024

| Stablecoins | Market Dominance (in %) | Trading Volume |

| Tether (USDT) | 70.24% | $52,783,767,044 |

| USDC | 21.26% | $6,850,180,550 |

| Dai | 3.32% | $434,353,918 |

| First Digital USD | 2.81% | $8,890,350,385 |

What are Stablecoins – Frequently Asked Questions

What is the world’s largest stablecoin?

Tether’s USDT is the world’s largest stablecoin with a market capitalisation of $110,258,908,025 as of April 2024.

Which crypto are stablecoins?

Tether’s USDT, USD Coin (USDC), Dai (DAI), and First Digital USD (FDUSD) are some of the crypto that are stablecoins

What risks are associated with stablecoins?

While stablecoins offer stable value to the crypto world, they are mostly controlled by central authorities, which brings back centralization. This exposes them to things such as lack of transparency and risks such as bank insolvency.

Can stablecoins be used for remittances?

Yes, stablecoins are increasingly being used for cross-border payments. They are much cheaper and faster, and they are also globally accessible.

Are stablecoins suitable for long-term investment?

Stablecoins are just a store of value, not an investment asset. Their value doesn’t grow over time, as other cryptocurrencies do.

What are stablecoins used for?

Stablecoins are mostly used as a medium of exchange when trading cryptocurrencies. They offer a stable value and a common trading pair for cryptocurrencies.

Reference

https://coinmarketcap.com/community/articles/662f53608576ff40e27bae3e

https://coinmarketcap.com/community/articles/663235a68613f0673a2a5588

https://coinmarketcap.com/community/articles/663235a68613f0673a2a5588